Margin investing is a robust Device that permits traders to amplify their market place exposure by borrowing resources to trade property. Although it may probably result in better income, Additionally, it comes along with enhanced possibility. Knowledge how margin trading works, its Added benefits, and its hazards is very important for anyone planning to navigate this monetary method correctly. This article supplies an in-depth evaluate margin investing, the way to utilize it proficiently, and The important thing criteria to bear in mind.

What exactly is Margin Buying and selling?

Margin investing requires borrowing income from the broker to trade monetary assets, for instance stocks, currencies, or commodities. The resources borrowed are accustomed to raise the sizing of your investing situation, letting you to manage a bigger amount of the asset than you can with just your own private money. This leverage can magnify the two your probable gains plus your likely losses.

So how exactly does Margin Trading Perform?

Opening a Margin Account: To have interaction in margin investing, you need to open up a margin account with a brokerage. This account differs from a regular buying and selling account mainly because it lets you borrow cash through the broker.

Leverage and Shopping for Ability: Leverage is expressed being a ratio, like two:1 or 10:one, indicating the proportion of borrowed cash to your own private capital. By way of example, with two:one leverage, you could control $20,000 worthy of of property with just $10,000 of your own private revenue. This will increase your shopping for energy and also the probable return on financial investment.

Margin Requirement: The margin prerequisite may be the minimum volume of your individual funds which you ought to deposit to open up and keep a place. This is often a share of the whole trade benefit. For illustration, a 50% margin necessity usually means you should deposit $five,000 to regulate $ten,000 worth of assets.

Interest on Borrowed Money: Once you borrow income to trade on margin, the broker costs fascination about the borrowed funds. This interest will likely be calculated daily and might affect your profitability, particularly if you keep positions over long durations.

Margin Phone calls: If the value within your placement falls plus your account fairness drops down below the required margin amount, the broker may well challenge a margin get in touch with. This suggests you need to deposit more cash or market some assets to carry your account back again to your expected degree. Failure to fulfill a margin simply call can result in the broker liquidating your positions to include the mortgage.

Advantages of Margin Trading

Enhanced Industry Exposure: Margin trading allows you to Handle bigger positions with fewer capital, potentially expanding your returns.

Limited-Advertising Prospects: Margin accounts permit you to shorter-sell, or wager in opposition to an asset, profiting from declines in its price.

Diversification: With more buying energy, you may diversify your portfolio throughout distinct property, reducing the danger related to any solitary financial investment.

Opportunity for Higher Returns: The leverage supplied by margin buying and selling can amplify your gains if the market moves in your favor.

Challenges of Margin Buying and selling

Increased Losses: Though leverage can raise profits, it could also amplify losses. If the industry moves versus your position, you can reduce greater than your initial expense.

Margin Calls: In case your account balance falls down below the demanded margin amount, you’ll really need to deposit further money promptly. When you fail to do so, your positions might be liquidated in a reduction.

Fascination Expenses: The curiosity on borrowed resources can include up, particularly when you hold positions for an prolonged period. These charges can try to eat into your revenue.

Marketplace Volatility: Margin investing is particularly risky in risky marketplaces, where by sudden selling price swings can result in immediate losses.

Very best Practices for Margin Buying and selling

Get started Small: If you’re new to margin buying and selling, get started with a little quantity of leverage to attenuate danger. While you get experience, you are able to little by little improve your exposure.

Use Cease-Decline Orders: Quit-reduction orders quickly shut your position if the market moves towards you by a certain quantity, helping to Restrict losses.

Keep an eye on Your Positions Carefully: Consistently Test your account equilibrium and also the overall performance of the positions to prevent unanticipated margin calls.

Teach Yourself: Continuously educate oneself on current market traits, technological Examination, and investing techniques to produce knowledgeable decisions.

Sustain a Cash Reserve: Hold a funds reserve as part of your margin account to go over potential margin phone calls and prevent pressured liquidations.

Conclusion

Margin trading gives significant opportunities for traders to enhance their market publicity and potentially increase returns. Nonetheless, In addition, it comes with considerable pitfalls, making it essential to solution it with warning plus a strong understanding of how it really works. By setting up small, making use of danger administration approaches, and being informed, you could navigate the complexities of margin buying and selling and work toward reaching your economical targets.

Irrespective of whether you’re a beginner trader or have some working experience beneath your belt, mastering the art of margin investing requires discipline, understanding, and also a properly-assumed-out method. With these instruments in hand, you are able to reap the benefits of the benefits whilst mitigating the pitfalls, paving the best way for achievement on the earth of margin buying and selling.

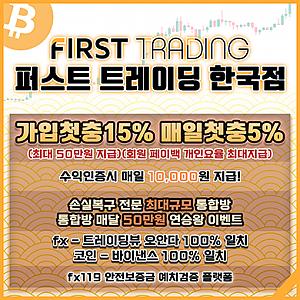

Get more info. here: fx마진거래